The Central Role of the Healthcare CFO

CFOs play a lead role in technology decisions across the hospital — not just approving budgets, but shaping which initiatives move forward in the first place. According to industry data, more than half of health tech purchases involve the CFO directly, making them one of the most influential stakeholders in the buying process.

Their influence has grown as hospitals face tighter margins and higher operational complexity. It’s no longer enough for a tool to be clinically useful or technically sound. If the financial case doesn’t hold up, the conversation usually ends there.

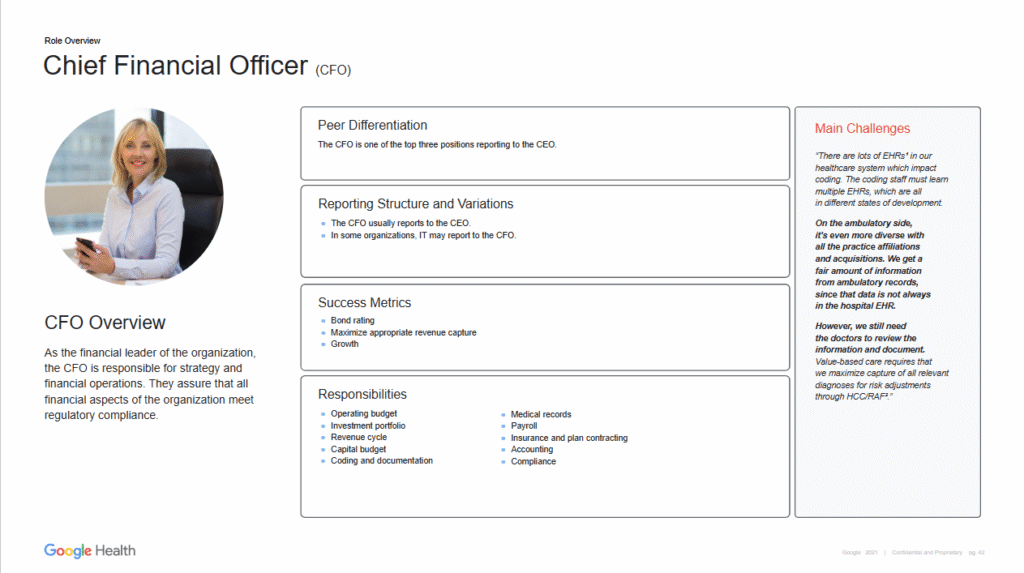

Part of this shift comes from how the CFO role itself has changed. It’s not just about overseeing budgets and managing audits. Today’s healthcare CFOs are expected to act as strategic partners — working alongside clinical, operational, and technology leaders to drive long-term growth and sustainability.

But with that broader scope comes greater scrutiny. When a CFO supports a new platform, they’re vouching for its financial logic and taking on accountability for how it affects costs, margins, and long-term outcomes. While the final sign-off may rest with the CEO or board, the CFO’s endorsement is often one of the deciding factors in whether a deal advances or stalls. That’s why treating them as a late-stage signoff usually leads nowhere.

For vendors, understanding this role is the starting point.

What Drives Healthcare CFO Decisions — Priorities and Concerns

Every CFO has a version of the same equation in mind: what’s the return, how soon does it show up, and what’s the risk if it doesn’t? That frame guides how they evaluate vendors. It’s not that they’re skeptical by default. It’s that they’ve seen what happens when optimistic projections fall apart under real-world conditions.

The first thing they look for is financial impact — specifically, hard ROI. Not productivity gains in theory, but actual numbers: lower contract labor spend, faster reimbursement cycles, fewer denials, improved revenue capture. The cleaner and more grounded the math, the better.

Cost visibility is another filter. CFOs don’t just want to know what something costs upfront. They want to understand the full financial picture — licensing, implementation, integration, support, renewal terms. Any ambiguity around total cost of ownership becomes a liability. If they have to ask twice about what’s included, they’re already moving on.

There’s also pressure to align spending with broader hospital goals. Even the best standalone tool can lose momentum if it feels disconnected from where the system is trying to go — value-based care, service line growth, patient flow optimization. When a solution clicks with a strategic initiative already in motion, the conversation moves faster. When it doesn’t, it feels like noise.

Margin pressure is the backdrop to all of this. Reimbursement cuts, labor shortages, rising fixed costs — CFOs are trying to navigate all of it at once. That’s why they’re cautious about anything that could tip the balance in the wrong direction. If a project adds new overhead or slows down cash flow, the upside has to be undeniable.

And even if the math works, implementation still matters. The fear isn’t just technical failure — it’s adoption failure. Will clinicians use it? Will it create new friction? Will the transition cost more than the solution saves? These are deal-breakers. Because no matter how good something looks in a limited rollout, it doesn’t count unless it works at scale.

Risk, in the end, isn’t just financial. There’s career risk on the line too. If a bet goes bad, the CFO is the one who has to answer for it — internally and, often, publicly. That’s why “no” can feel safer than “yes,” unless the story is tight, the numbers check out, and the rollout plan is already mapped.

How to Win CFO Approval

By the time a proposal reaches the CFO, most of the surface-level selling should already be done. What they’re looking for now isn’t persuasion, but proof. A clear business case, backed by numbers that hold up, and structured in a way that lets them make a confident decision without chasing down extra context.

Start with ROI, but go deeper than a single number. Break down how savings or gains are achieved. If you’ve seen results at other health systems, show those outcomes in plain terms — percent reductions, dollar amounts, timeframes. Don’t bury the results in buzzwords.

- Case studies and timelines help. A single sentence like “Hospital X saved $2M annually after reducing ER readmissions by 25%” can carry more weight than a full slide deck. Just make sure the timelines are realistic — and that what you’re promising feels achievable under current conditions.

- Speak in terms they use internally. Cost centers, budget cycles, payback periods, capital vs. operating spend. The more your proposal fits into their model, the less work they have to do.

Risk reduction is just as important as upside. Most CFOs aren’t looking to be convinced of potential. They’re looking to be reassured that if things go sideways, the downside is limited.

- Offer pilots, phased rollouts, or outcome-based pricing where appropriate. These signal that you understand the financial calculus behind enterprise purchasing.

- Be clear about what’s needed internally to make things work. Integration support, change management, staff training — these don’t need to be long sections, but they need to be addressed. Silence on execution reads as risk.

Engagement matters earlier than most vendors realize. If the CFO only sees the deal at the end, they’re stepping in cold — and probably with a longer list of concerns. Instead, the strongest proposals build alignment early. Try to find out what their priorities are before the pitch. Ask, listen, and adjust to make sure what you’re offering actually fits.

When done right, the decision starts to feel less like a risk and more like a step forward.

The CFO Is Not Just a Budget Gatekeeper Anymore

CFOs sit at the intersection of opportunity and risk. Every decision they make involves a tradeoff — and in healthcare, those tradeoffs are getting harder. Budgets are tighter. The margin for error is smaller. And every investment is judged by whether it moves the system forward without tipping anything else over.

For vendors, this isn’t a barrier. It’s a signal. The better you understand a CFO’s priorities — financial impact, cost clarity, risk exposure — the better your odds of building real traction. If you can show ROI, prove adoption, and align with strategic goals, you’re solving a problem they’ve already been tasked with fixing.

Get that part right, and the CFO isn’t a hurdle, but the reason the deal happens.