Canada’s digital health ecosystem is at a defining stage. In 2024, Canada’s digital health market generated an estimated US$13.49 billion in revenue and is projected to reach US$53.92 billion by 2030 (about a 26% CAGR).

Backed by government programs like DIGITAL, Canada’s Global Innovation Cluster for digital technologies, and anchored by a single-payer health system and strong research institutions, the country is producing globally competitive companies in AI, diagnostics, telehealth, and biotech.

This list highlights startups that show clear traction — whether by raising significant rounds, securing major partnerships, or launching breakthrough technologies. Some are clinical-stage biotechs; others are digital platforms already used by millions. All of them are worth watching in 2026 and beyond.

Digital Health Startups Leading the Way in Canada

1. MetaOptima

Founded: 2012 | Location: Vancouver, British Columbia | Category: Dermatology AI tools

MetaOptima has raised about USD 9.12 million across six funding rounds to build AI-powered dermatology solutions.

Its products include MoleScope, a mobile dermatoscope that attaches to smartphones, and DermEngine, an intelligent imaging and analytics platform used by clinicians worldwide. Co-founded by Maryam Sadeghi and Majid Razmara, the company aims to make skin care faster, more accurate, and more accessible. In 2023, MetaOptima was selected for the Healthtech SME Program in British Columbia, receiving a share of $4.7 million in regional grant funding to accelerate adoption.

2. Dialogue

Founded: 2016 | Location: Montreal, Québec (operates nationally) | Category: Virtual care and wellness platform

Dialogue has raised about USD 88 million across four funding rounds to build one of Canada’s most comprehensive virtual care platforms. Its services span primary care, mental health, and employee assistance programs, and today it reaches nearly 2.8 million members across 50,000 organizations.

In October 2023, Sun Life Financial acquired Dialogue for C$365 million, though it continues to operate as a standalone unit. The company’s growth reflects the consolidation trend in virtual healthcare, where integrated solutions are replacing one-off apps.

3. Swift Medical

Founded: 2015 | Location: Toronto, Ontario | Category: AI-powered wound care

Swift Medical has raised about USD 48 million across five funding rounds to build its AI-driven wound care platform, now used in nearly 4,000 healthcare facilities globally. In October 2024, the company launched Swift Skin & Wound 2, a next-generation tool offering high-precision imaging, documentation, and analytics.

Clinical results show measurable outcomes, including up to 35% faster wound healing and a 15% reduction in hospitalizations. To expand equitable access, Swift secured a CAD 4.5 million co-investment from Canada’s DIGITAL cluster in 2024, reinforcing its role as a leader in evidence-backed, technology-enabled wound care.

4. PocketPills

Founded: 2018 | Location: Surrey, British Columbia | Category: Online pharmacy

PocketPills, founded by two pharmacists and an engineer, has raised about USD 30.8 million across three funding rounds, including a $30 million CAD Series B in 2021 that valued the company at USD 150 million. As Canada’s first full-service digital pharmacy, it offers online prescription management, telehealth, and free home delivery, using AI to automate prescription data and improve communication between pharmacists and patients.

The platform now has over 300,000 registered users, and in 2023 it was selected by the Benefits Alliance as a preferred digital pharmacy provider, further cementing its role in reshaping medication access and affordability nationwide.

5. Felix health

Founded: 2019 | Location: Toronto, Ontario | Category: On-demand virtual care and online prescriptions

Felix Health has raised about C$31 million (USD 24 million) across multiple rounds, including a C$18 million Series B in April 2023. Positioned as Canada’s first fully integrated healthcare platform, Felix offers on-demand treatment for everyday needs like weight management, sexual health, acne, and mental health—delivered through virtual consultations and seamless prescription delivery, often covered by insurance.

With more than 540,000 registered users and rapid year-over-year growth, Felix is reshaping how Canadians access routine care from the comfort of home.

6. BlueDot

Founded: 2008 (relaunched 2013) | Location: Toronto, Ontario | Category: Epidemiological AI surveillance

BlueDot has raised about USD 9.95 million across six funding rounds, most recently securing a C$3 million FedDev Ontario grant in January 2023 to expand its AI-powered infectious disease forecasting tools.

The company uses machine learning and big data to track and predict outbreaks worldwide, and is best known for sending one of the earliest global alerts on COVID-19 on December 31, 2019, days before international health authorities acted. BlueDot’s models have also accurately anticipated the spread of Ebola and Zika, making it one of Canada’s most recognized healthtech innovators in epidemiological intelligence.

7. AlayaCare

Founded: 2014 | Location: Toronto, Ontario | Category: Home and community care software

AlayaCare has raised more than USD 274 million across multiple rounds, including a C$225 million Series D in 2025, to build its cloud-based platform for home and community care providers. The software manages everything from intake and scheduling to care planning, billing, payroll, and data, all accessible via desktop and mobile apps.

Already serving clients in Canada, the U.S., and Australia, AlayaCare is positioning itself for deeper U.S. expansion as demand for scalable, tech-enabled home care solutions continues to grow.

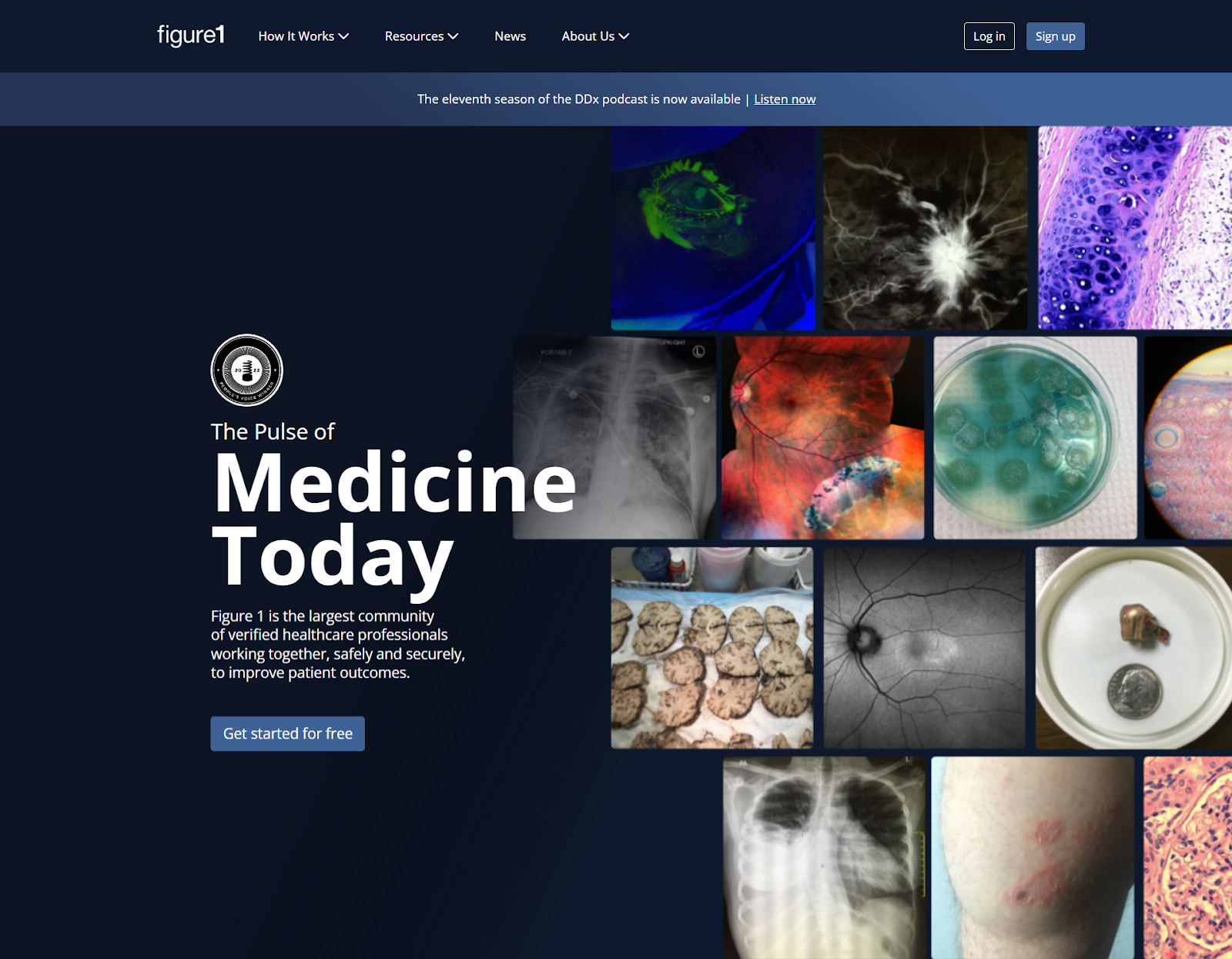

8. Figure 1

Founded: 2013 | Location: Toronto, Ontario (global reach) | Category: medical case-sharing social network

Figure 1 has raised about USD 20.9 million across multiple funding rounds, including a Series B in 2017, to build its peer-to-peer case-sharing network for healthcare professionals. Sometimes dubbed the “Instagram for doctors,” the platform enables clinicians to share de-identified medical cases and images, exchange diagnostic insights, and learn from a global community.

Today it serves over 1 million healthcare professionals in 100+ countries. With strict privacy protocols and growing adoption, Figure 1 has become a widely recognized hub for collaborative medical learning.

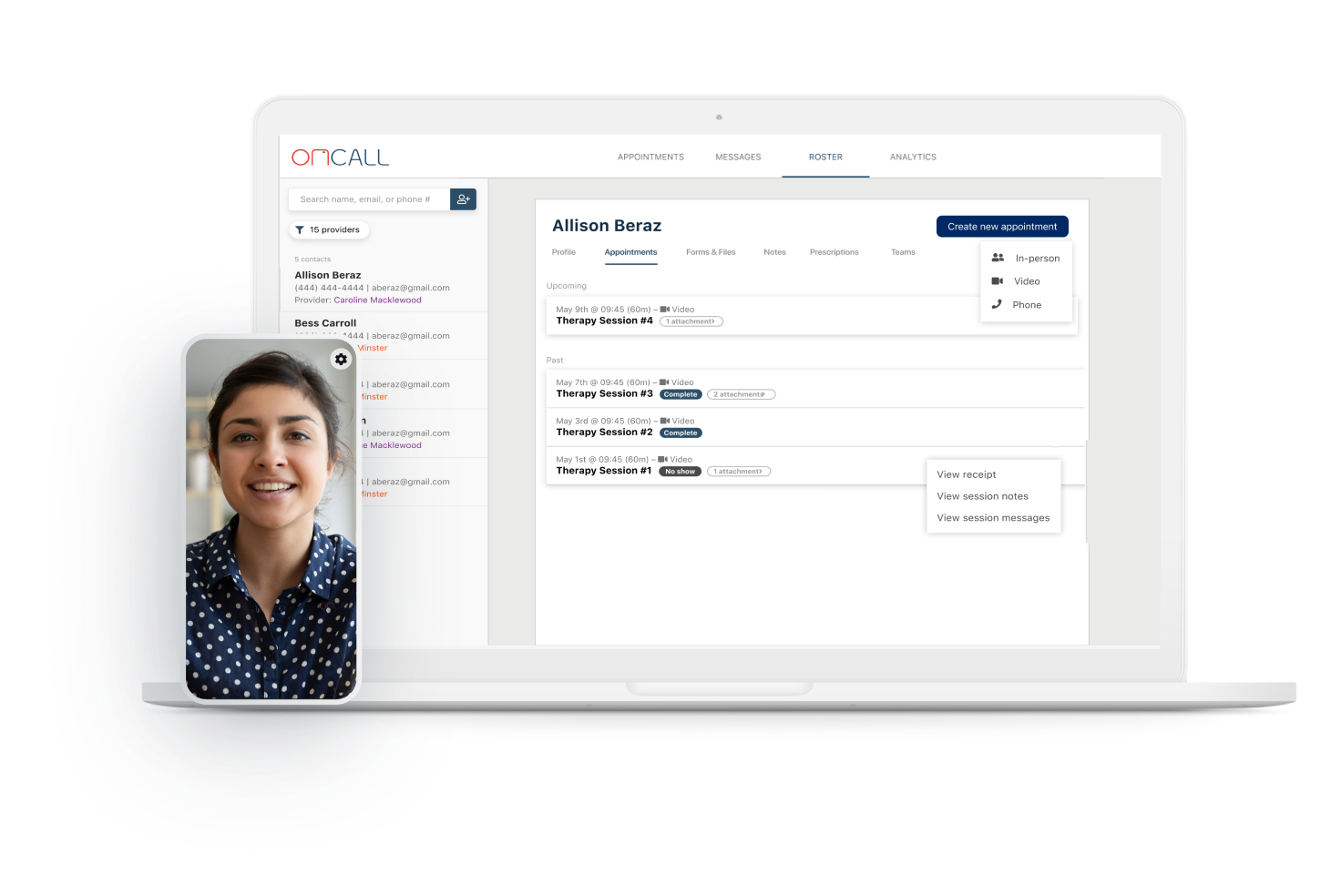

9. OnCall Health

Founded: 2016–2017 | Location: Toronto, Ontario | Category: virtual care software for healthcare providers

OnCall Health has raised about USD 18.6 million in total funding, including a CAD 7.9 million Series A in 2020 led by Base10 Partners, to expand its fully configurable virtual care platform. Built for healthcare providers, the software supports booking, triage, secure video visits, billing, e-prescriptions, and analytics.

Today, it powers over 1 million virtual appointments each year, serving 600 organizations and more than 7,000 providers across North America. OnCall’s focus on customization has helped it become a trusted infrastructure partner for clinics, hospitals, and enterprises seeking to deliver care online.

10. Sprout (Sprout Family)

Founded: 2023 | Location: Toronto, Ontario | Category: fertility, surrogacy, and adoption care benefits for employers

Sprout has raised C$1.7 million in a pre-seed round (March 2025) to grow its employer-facing benefits platform for inclusive family building. The service gives employees access to fertility, surrogacy, and adoption support, along with unlimited virtual care, and educational resources.

In 2023, Sprout partnered with Canada Life, extending its coverage to millions of Canadians and positioning itself as a leading provider of workplace family-building benefits.

11. Kii Health (formerly CloudMD)

Founded: legacy CloudMD; Kii brand launched 2022 | Location: Toronto, Ontario | Category: Integrated workplace health and wellbeing

Kii Health, originally launched as CloudMD, rebranded its integrated services under the Kii name in 2022 to unify its broad healthcare offerings. The platform spans mental health support, primary and specialist care, EFAP programs, occupational health and safety, disability management, and remote second opinions.

In July 2024, CloudMD was taken private by CPS Capital in a deal valuing the equity at about C$12 million (enterprise value of ~C$36 million including debt), with the company continuing operations under the Kii Health brand. Positioned as an all-in-one health and wellbeing provider, Kii is focusing on building scalable, technology-driven services for workplaces across North America.

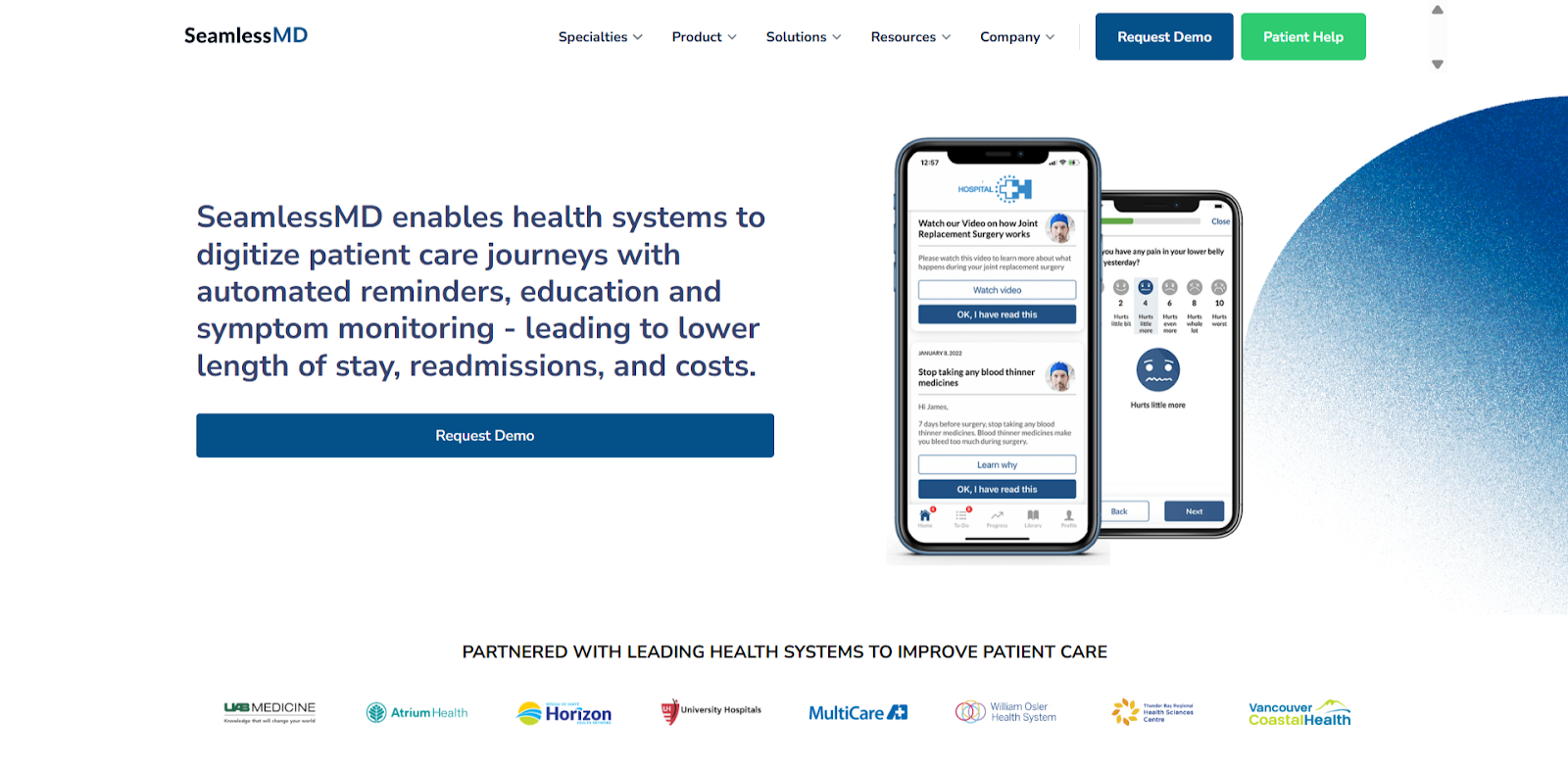

12. SeamlessMD

Founded: 2012 | Location: Toronto, Ontario | Category: Digital patient engagement and remote monitoring

SeamlessMD has raised about C$7.4 million, including a C$4 million Series A in 2020 led by MEDTEQ+ and Hikma Ventures, to expand its “digital care journey” platform. The software integrates with major EMRs like Epic and Cerner to guide patients through surgeries and chronic disease care with reminders, education, and symptom tracking.

Clinical studies highlight significant results: Hoag Hospital reported a 15% shorter length of stay and 28% fewer readmissions, while Sault Area Hospital saw 72% fewer ER visits and 64% fewer readmissions in urology. With more than 35 evaluations and studies validating its impact, SeamlessMD is gaining recognition as a trusted partner for health systems adopting digital care pathways.

13. ThoughtWire

Founded: 2009 | Location: Toronto, Ontario | Category: Smart hospital operations and digital twin platform

ThoughtWire has raised more than $22 million, including a C$20 million Series A in 2018 and a further $8.49 million in 2020, to develop its real-time digital twin platform for healthcare and smart buildings. In hospitals, its applications include EarlyWarning, which detects patient deterioration early to reduce code-blue calls, and SynchronizedOps, which improves patient flow and care coordination.

The technology has been deployed at sites like Oak Valley Health, where Microsoft reported that the Early Warning Network nearly eliminated code-blue emergencies, and at Hamilton Health Sciences, as well as in Ontario’s province-wide LTC eConnect rollout. ThoughtWire positions itself at the intersection of AI, IoT, and healthcare operations, helping health systems move toward proactive, data-driven care.

14. Aifred Health

Founded: 2017 | Location: Montreal, Québec | Category: AI decision-support for depression

Aifred Health has raised US$4 million in seed financing led by MEDTEQ+ and BDC Capital, and later secured an additional US$1 million in prize funding as runner-up in the IBM Watson AI XPRIZE. The company develops an AI-powered clinical decision support tool that helps physicians personalize treatment plans for patients with moderate to severe depression by predicting which therapies are most likely to succeed.

In September 2024, Aifred received Health Canada approval for its AI-assisted medical device for depression care, marking a major milestone in bringing evidence-based, AI-driven mental health tools into clinical practice.

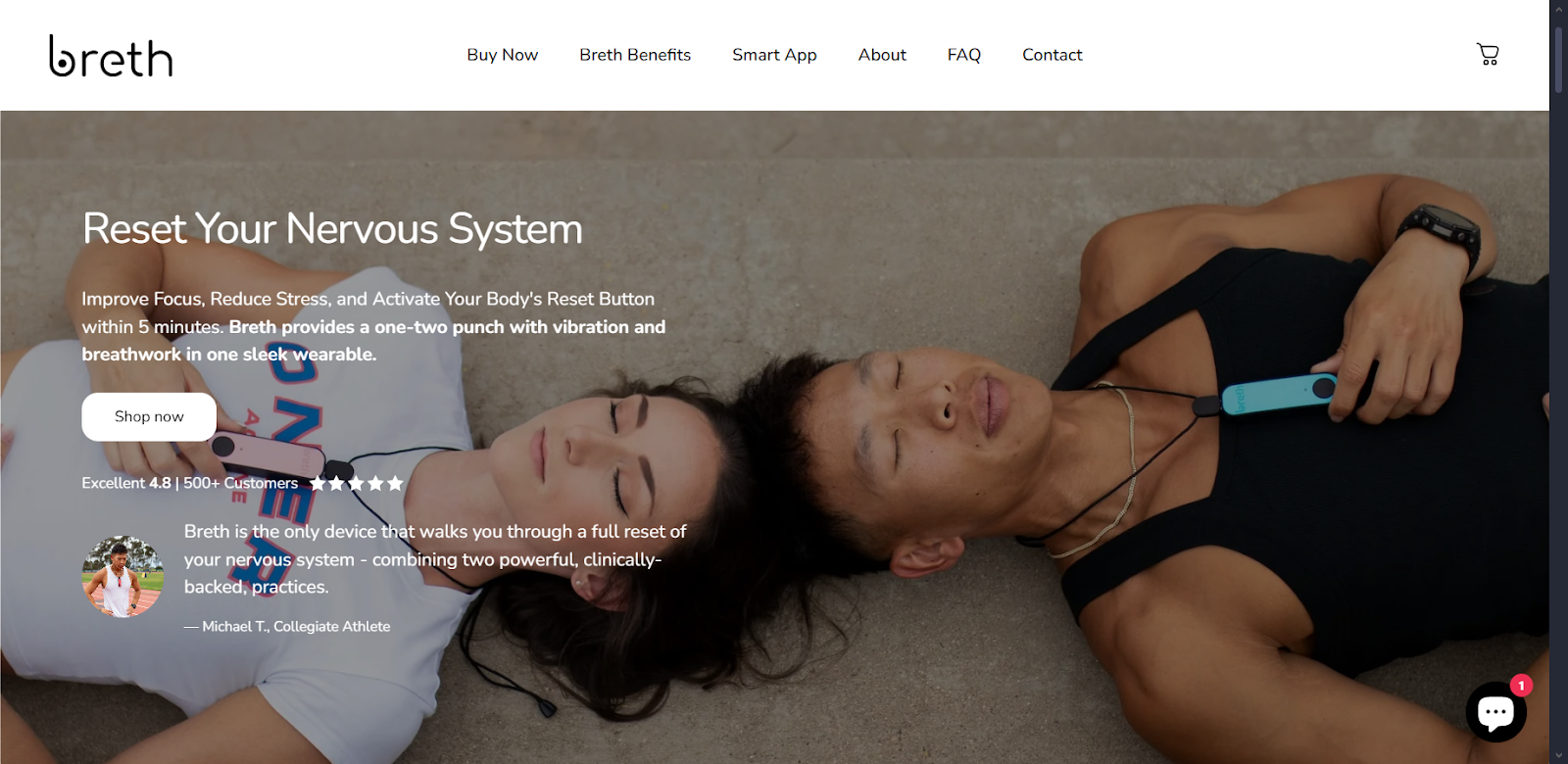

15. Breth

Founded: 2022 | Location: Edmonton, Alberta | Category: Wearable breathwork & biofeedback

Breth, created by the team behind True Angle’s clinically adopted Mobili-T therapy device, is a sternum-worn wearable that delivers multisensory breathwork training. The device uses near-silent haptic cues synchronized with audio and visuals in a companion app, personalizing sessions to a user’s baseline breathing. It offers targeted modes for focus, energy, sleep, and stress relief, positioning itself at the intersection of consumer wellness and clinical biofeedback.

Co-founded by Dr. Jana Rieger (CEO) and Dylan Scott (CTO), Breth began rolling out in 2025 and has already gained recognition — Dr. Rieger was named 2024 Woman in Tech by Start Alberta for her leadership in health innovation.

16. Think Research

Founded: around 2006 | Location: Toronto, Ontario (operates Canada-wide) | Category: digital clinical decision support and knowledge tools

Think Research provides digital decision support and knowledge platforms that help clinicians deliver better care through tools like order sets, eForms, eReferrals, onboarding modules, and clinical content libraries. Its solutions are used across Canada and abroad to improve workflows and patient outcomes.

Before its acquisition, the company raised an estimated US$25 million in funding across multiple rounds. In February 2024, Beedie Capital announced it would acquire Think Research in an all-cash deal valued at about C$85 million, with the company continuing to operate under its brand.

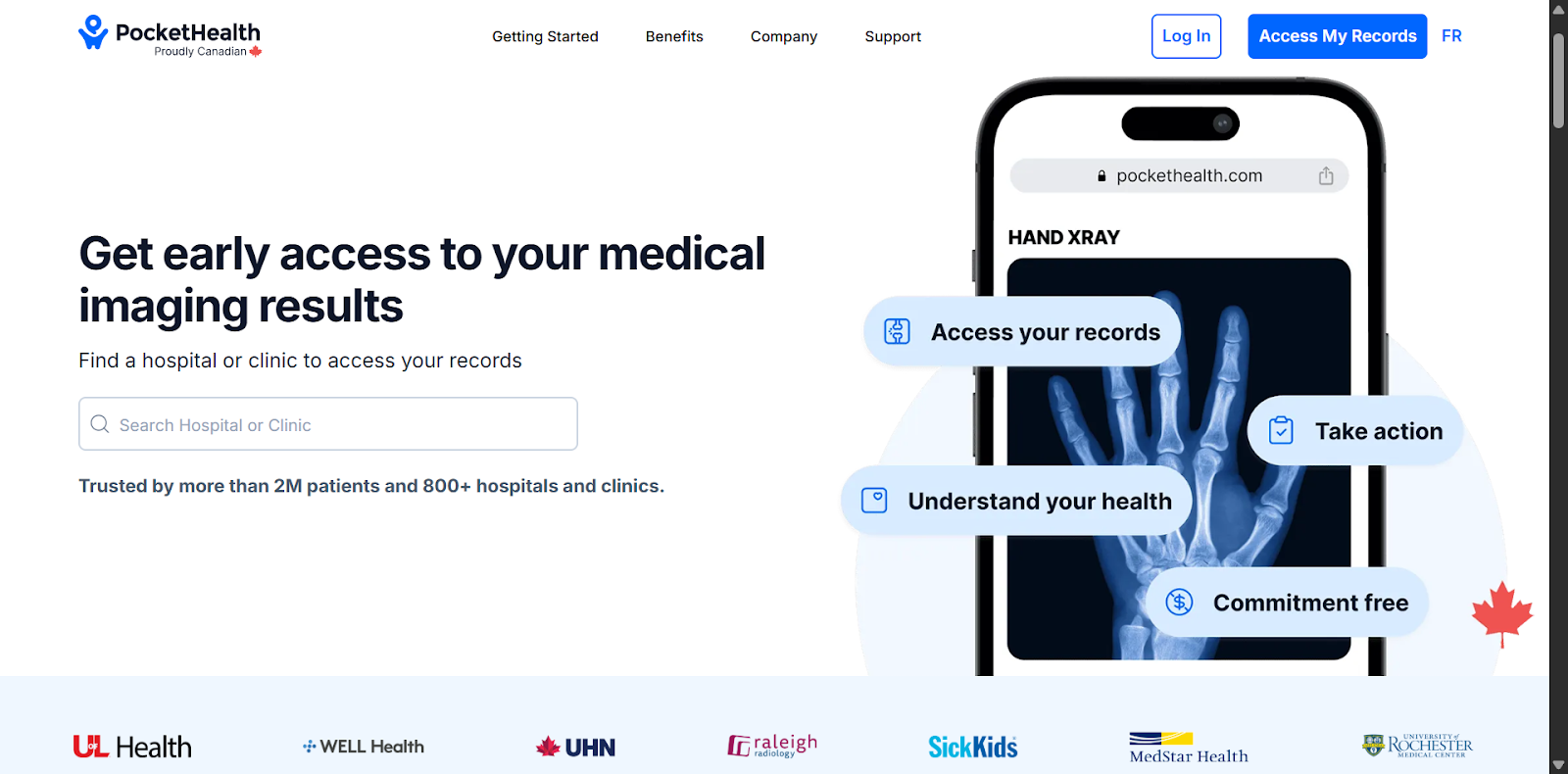

17. PocketHealth

Founded: 2016 | Location: Toronto, Ontario (North America-wide reach) | Category: patient-centric medical image sharing

PocketHealth has raised about US$55.5 million (C$75 million) in total funding, including a US$33 million (C$45 million) Series B in March 2024 led by Round13 Capital. The platform enables patients to access, store, and securely share their diagnostic images — from MRIs and x-rays to ultrasounds — while integrating directly with hospitals and clinics.

As of 2024, PocketHealth is used by over 2 million patients across more than 800+ healthcare sites in North America. By shifting control of imaging data into patients’ hands, it helps reduce inefficiencies and gives individuals more ownership over their health information.

18. Newtopia

Founded: 2008 | Location: Toronto, Ontario | Category: Habit-change platform for chronic disease prevention

Newtopia is a habit-change platform that works with employers and insurers to prevent and manage chronic conditions such as diabetes, hypertension, and obesity. It combines personalized coaching, connected devices, and data tracking to build sustainable health outcomes.

Since 2011, the company has raised US$13.1 million across 10 rounds, including a US$550K Post-IPO raise in February 2024 and earlier Post-IPO financings in 2022 and 2023. With backing from investors like Bloom Burton and BDC, Newtopia is scaling its platform in Canada and the U.S. as a preventive health solution for large populations.

Signals for Investors: What These Startups Reveal

Here’s what VCs and other digital health founders should know about Canada’s digital health space:

- AI is Canada’s wedge in global health. Companies like Swift Medical, BlueDot, and Aifred show how Canada is exporting AI-driven solutions into wound care, outbreak tracking, and oncology.

- Virtual care is consolidating. Dialogue, Felix, and Kii Health reflect a trend toward integrated, employer-aligned platforms rather than standalone apps.

- Patient empowerment is central. PocketPills, PocketHealth, and SeamlessMD emphasize giving patients more control over prescriptions, imaging, and care journeys.

- Canada is a launch pad, not just a local play. Many of these startups are already entering the U.S. or global markets, making them valuable signals for investors scouting cross-border scale.

Final Thoughts on Digital Health Startups in Canada

For U.S. and global investors, Canada offers more than proximity — it offers startups validated in a single-payer system, operating with strong academic ties, and often ready for export.

Whether it’s AI-enabled diagnostics, consumer-grade virtual care, or breakthrough therapies, Canada’s healthtech scene is now producing startups with both local resilience and global relevance.

Check out our other roundups on digital health startups in the UK, India, and the Middle East.