Five years after digital health’s post-pandemic boom, the sector looks very different. Valuations have reset, growth rates have normalized, and only a few public names have managed to deliver steady returns.

This analysis looks at how leading digital health stocks have performed since 2020 and what their financial results reveal about sustainable growth in the sector.

Here are 6 companies whose performance offers a focused view of how certain digital health models have held up over the last five years.

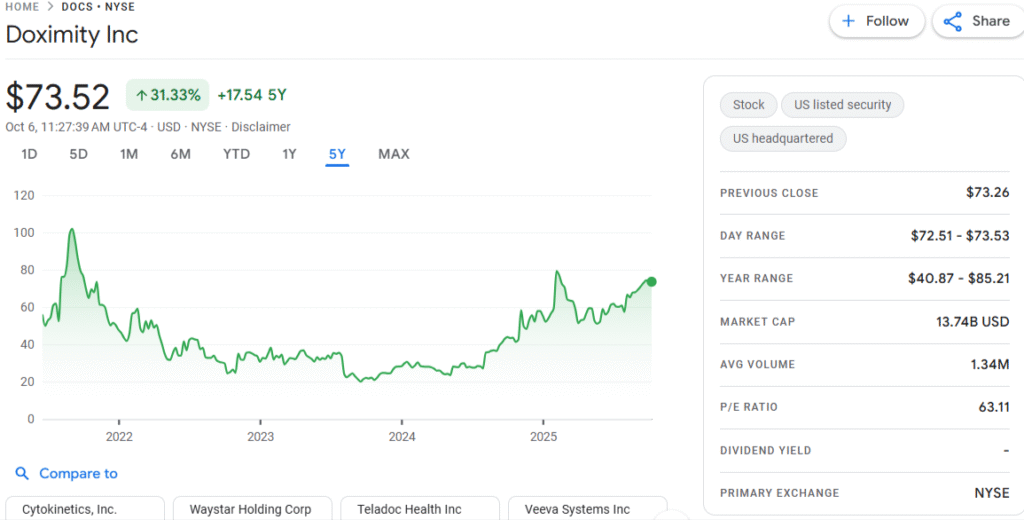

Doximity (NYSE: DOCS)

Doximity shares have increased about 31% over the past five years, closing at $73.52 on October 6, 2025. The company’s market capitalization is $13.7 billion, with a P/E ratio of 63.1. The stock has traded between $40.87 and $85.21 over the past year.

For fiscal 2025, Doximity reported revenue of about $570 million, an increase of roughly 20% year over year, and maintained net income margins of around 39%. The company’s network includes more than 80% of U.S. physicians, according to Investor’s Business Daily, and most of its revenue comes from recurring subscription contracts related to professional marketing, recruiting, and telehealth services.

Over the five-year period, Doximity’s financial performance has been supported by consistent profitability and a high proportion of subscription-based revenue, helping it remain one of the more stable digital health stocks in the public market

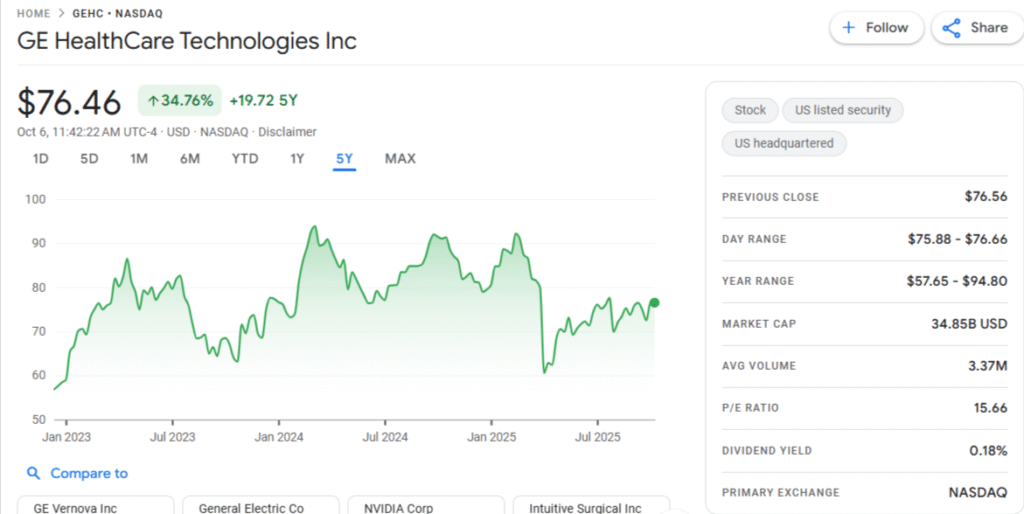

GE HealthCare Technologies Inc (NASDAQ: GEHC)

GE HealthCare shares have risen about 35% since their 2023 spin-off, closing at $76.46 on October 6, 2025. The company’s market capitalization is $34.85 billion, with a P/E ratio of 15.7 and a dividend yield of 0.18%. Over the past year, the stock has traded between $57.65 and $94.80.

For fiscal 2024, GE HealthCare reported revenue of about $19.67 billion and an adjusted EBIT margin of 16.3%. The company relies heavily on recurring revenue from service contracts, software maintenance, and consumables tied to its imaging and diagnostics equipment.

In 2025, GE HealthCare reported an adjusted EBIT margin of 14.6% for the second quarter and raised its full-year 2025 guidance to 15.2–15.4%, reflecting moderate margin pressure amid continued growth in core medical imaging and patient monitoring segments.

GE HealthCare has concentrated on core medical-technology areas, including diagnostic imaging, ultrasound, patient monitoring, and associated software and consumables. Its performance since becoming independent shows modest growth and margin expansion, leveraging its installed equipment base and recurring service business.

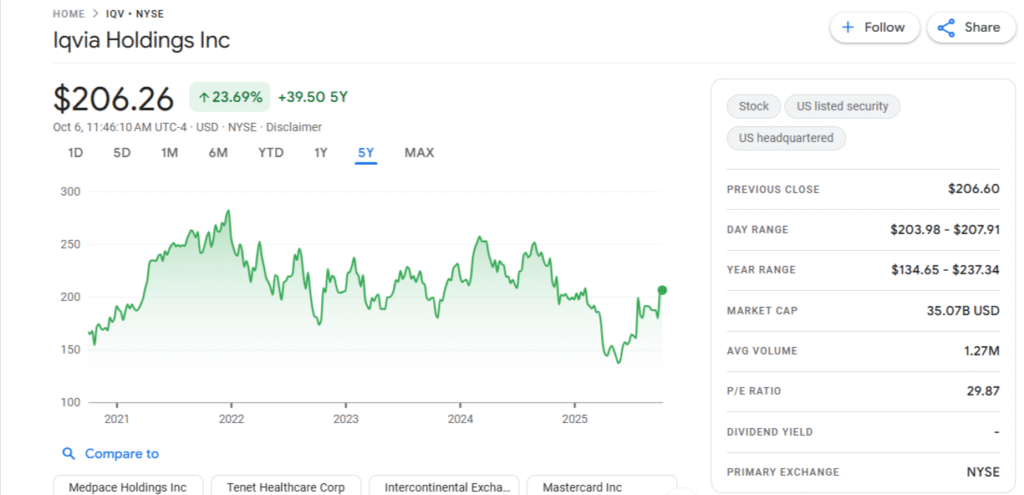

IQVIA Holdings Inc (NYSE: IQV)

IQVIA shares have gained about 24% over the past five years, closing at $206.26 on October 6, 2025. The company’s market capitalization is $35.07 billion, with a P/E ratio of 29.9. The stock has traded between $134.65 and $237.34 over the past year.

In fiscal 2024, IQVIA reported revenue of about $15.405 billion, representing a ~2.8% increase over 2023. Its operating margin (on an accounting basis) is approximately 12%.

The company derives the bulk of its revenue from providing services to life sciences organizations, including contract research (clinical trials), analytics, and technology platforms. Over the past several years, IQVIA’s growth has been underpinned by multi-year contracts, recurring analytics and platform revenue, and its large global footprint.

LifeMD Inc (NASDAQ: LFMD)

LifeMD shares have risen about 397% over the past five years, closing at $7.01 on October 6, 2025. The company’s market capitalization is $313.5 million, and the stock has traded between $3.99 and $15.84 over the past year.

LifeMD operates as a direct-to-consumer telehealth company offering virtual care, diagnostic services, and prescription delivery. As of mid-2025, the company reported second-quarter revenue of $62.2 million, up 23 percent year over year, and projected full-year 2025 revenue of $250 million to $255 million. The company has continued expanding its subscription-based care programs, pharmacy operations, and diagnostics offerings.

Following earlier volatility in the telehealth sector, LifeMD’s recent growth has been supported by its recurring subscription model and ongoing investment in digital care delivery and platform integration.

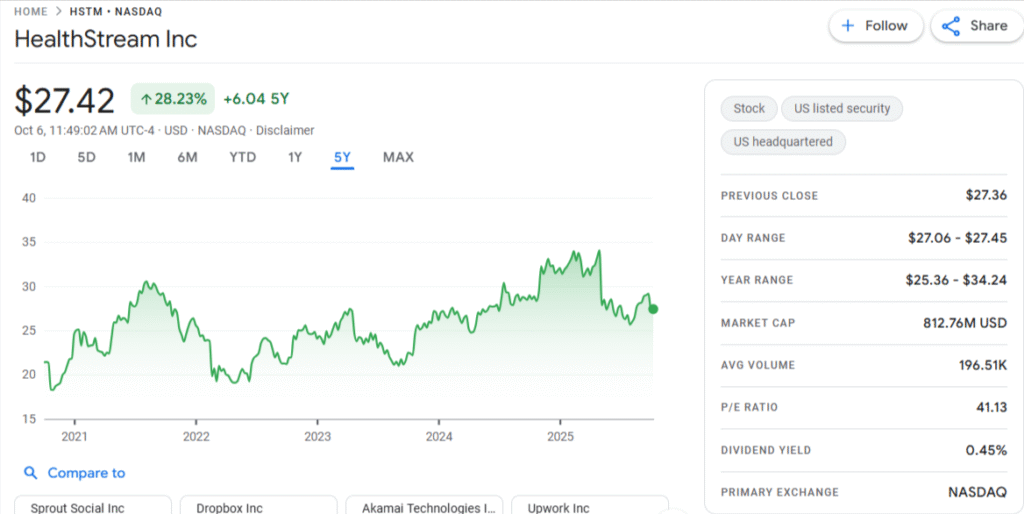

HealthStream Inc (NASDAQ: HSTM)

HealthStream shares have increased about 28% over the past five years, closing at $27.42 on October 6, 2025. The company’s market capitalization is $812.8 million, with a P/E ratio of 41.1 and a dividend yield of 0.45%. Over the past year, the stock has traded between $25.36 and $34.24.

HealthStream provides subscription-based software for workforce training, credentialing, and compliance management in healthcare organizations. In the first quarter of 2025, the company reported revenue of $73.5 million, up about 1 percent year over year, with operating income of $4.4 million. It also guided for full-year 2025 revenue between $297.5 million and $303.5 million.

HealthStream generates most of its revenue from recurring software subscriptions and licensing agreements. In its 2023 filings, the company disclosed that the vast majority of its net revenue came from SaaS and licensing services.

The company’s recurring model continues to support modest but steady revenue growth and consistent profitability, reflecting the stability of its software platform within U.S. healthcare workforce management.

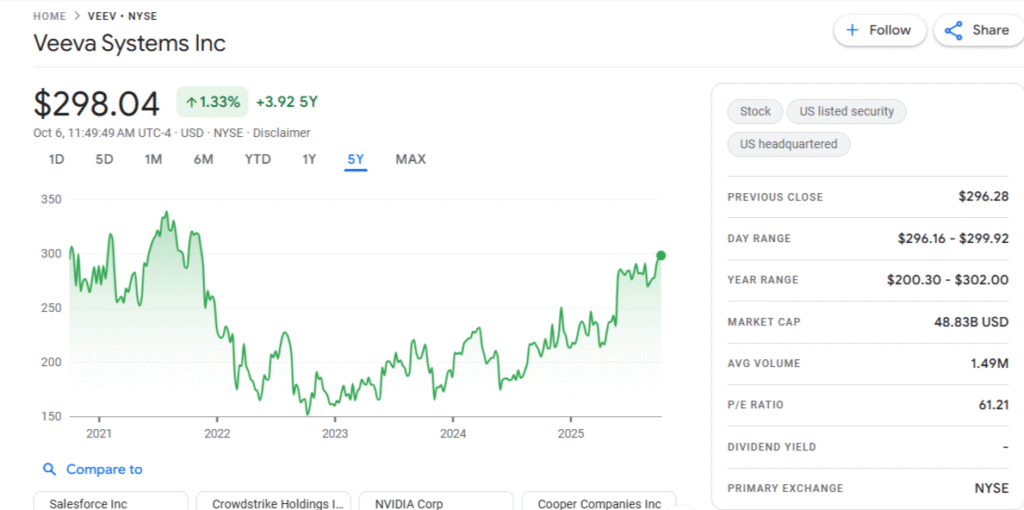

Veeva Systems Inc (NYSE: VEEV)

Veeva Systems shares have risen about 1% over the past five years, closing at $298.04 on October 6, 2025. The company’s market capitalization is $48.83 billion, with a P/E ratio of 61.2. Over the past year, the stock has traded between $200.30 and $302.00.

For fiscal 2025, Veeva reported total revenue of about $2,746.6 million, representing a ~16% increase year over year. The company posted a Generally Accepted Accounting Principles (GAAP) operating margin of 25.2 %.

Veeva earns the majority of its revenue from subscription-based software and associated services used by life sciences firms for customer relationship management, data management, and clinical operations. Over the past several years, its growth has been underpinned by recurring revenue, high customer retention, and expansion in its software stack.

Because Veeva is anchored in the life sciences software sector and delivers predictable subscription revenue with healthy margins, it tends to be viewed as a more stable name among large-cap healthcare tech and enterprise software companies.

Patterns Across Digital Health Leading Stocks (2020–2025)

The companies reviewed here show how different segments of digital health have evolved since 2020. While not a complete picture of the market, their results highlight patterns among consistently profitable and publicly traded firms that operate at the intersection of healthcare delivery, infrastructure, and data.

A few themes stand out. Recurring and contract-based revenue models remain the defining feature across most of these companies. Doximity, HealthStream, Veeva, and IQVIA continue to draw the majority of their income from subscriptions or long-term service agreements. GE HealthCare relies heavily on recurring streams through service contracts, consumables, and insurance premiums, providing revenue visibility even in slower growth years.

Profitability and moderate growth have outperformed scale-at-all-costs models. Companies with positive margins — like Doximity, GE HealthCare, Veeva, and HealthStream — showed steadier stock performance than faster-growing peers that struggled with losses. The strongest operators have paired recurring revenue with disciplined cost structures rather than pursuing aggressive expansion.

Alignment with core healthcare systems and reimbursement frameworks has been another stabilizing factor. The companies most exposed to regulated healthcare infrastructure — GE HealthCare and IQVIA — benefited from steady demand tied to essential services. Meanwhile, newer entrants like LifeMD have recovered by focusing on subscription-based virtual care and integrated pharmacy operations rather than broad telehealth expansion.

Overall, the data points to a maturing digital health market, where reliable revenue and margin stability matter more than rapid top-line growth. These firms demonstrate how recurring revenue, integration with healthcare operations, and operational discipline can sustain long-term performance — even as broader sector valuations remain uneven.

Conclusion

The performance of these selected digital health companies over the past five years offers a narrow but useful view into what has worked in the public markets. Each shows how recurring revenue, alignment with established healthcare structures, and disciplined operations can support consistent results, even through market shifts.

These examples don’t define the full digital health landscape, but they underscore where investors have found stability: in businesses built around essential services, data, and infrastructure. For investors watching this space in 2026, the takeaway is that durable growth tends to appear where technology supports, rather than tries to replace, the healthcare system itself.